Saturday, 29 February 2020

Definition of Econometrics

Econometrics is the most advanced form of Applied Statistics, in which we analyze/measure the Quantitative Statistical data to find a result for reaching appropriate conclusions of data.

Econometrics is basically a combination of two words. "Econo" which is taken fro Economics while "Metrics" is the Greek word mean as Measurement. so basically and essentially Econometrics includes all those Statistical and Mathematical techniques that are used in the analysis of Economic data.

Thursday, 27 February 2020

Descriptive Statistics in EViews and its interpretation

Hello Friends,

In today's lecture, we will go and find Descriptive statistics by e-views. now a question arises why would we require descriptive statistics.here are a few reasons.

In today's lecture, we will go and find Descriptive statistics by e-views. now a question arises why would we require descriptive statistics.here are a few reasons.

- It enables us to present the data in a more meaningful way, which allows a simpler interpretation of the data.

- The main purpose of descriptive statistics is to provide a brief summary of the samples and the measures done on a particular study.

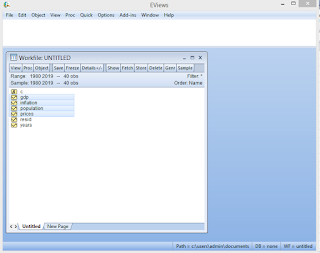

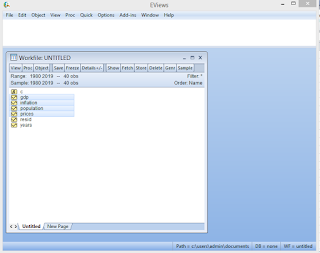

now open e-views and import data from the excel sheet. so finally you would be here.

then open the complete data table by pressing enter key (after selecting variables)

now select Views from the menu bar

from view we have to select the "Descriptive Stats" option and then "Common Sample" and here we have the result window and it would be like that.

-------------------------------------------------------------------------------------------------------------------------- Interpretation of Descriptive Stats

Suppose ve have Results like that. then

Description

|

GDP

|

Inflation

|

Population

|

Price

|

Mean

|

4.005952

|

5.410366

|

3358333.

|

176.2366

|

Median

|

4.232143

|

5.805868

|

3358333.

|

176.2366

|

Maximum

|

5.200000

|

8.440000

|

5503333.

|

340.6911

|

Minimum

|

1.800000

|

1.200000

|

1200000.

|

10.00000

|

Stad. Deviation

|

0.829710

|

2.070294

|

1285960.

|

98.75186

|

Variance

|

0.672400

|

4.286117

|

----

|

9751.5625

|

Skewness

|

-1.007070

|

-0.441171

|

-9.12E-05

|

-0.012148

|

Kurtosis

|

3.144214

|

2.104262

|

1.798769

|

1.818367

|

here we have mean of

GDP, Inflation, Population, and Prices which explains the average of the data.

Whereas Median explains the central value of the data. Maximum and minimum

value expresses the range 0f data. Now moving towards the standard deviation we

got how much data deviate from its central point. In our data, we can see that

skewness is normal and positive for every four variables. When we talked about Kurtosis it must be below 3. GDP has 3.14>3 so we

can say that GDP is positively skewed with slight leptokurtic shape. Reaming

variables (Inflation, Population, and Price) are less than 3 Kurtosis as well as

positively skewed and have Masokartic shape.

Wednesday, 26 February 2020

Ordinary Least Square (OLS) in EViews and its Interpretation

In the Regression analysis of Econometric first of all, we should have to calculate OLS.

Because OLS is most essential for the following reasons.

Because OLS is most essential for the following reasons.

- it is one of the simplest methods to measure Regression.

- widely used to estimate the parameter of a linear regression model.

- it minimizes the sum of the squared errors.so we can say that is one that has minimum variance.

- it is used to model the relationship between a continuous response variable y and an explanatory variable x.

- it is an unbiased Estimator.

- it is concerned with the squares of the errors.

Now we are moving towards the solution and finding of OLS by E-views.

- Import the data from the Excel sheet and then by clicking the right-hand button from the mouse you can see the "paste" command just click on it.

2. Select the Dependent (DV) and independent variables(IVs).

3. By Putting Cursor on Selected Variables, Right-click from muse then selects "open" then "Group" after that click on it. Now your new window will be like that,

4. Now click in "Quick" from the Manue Bar.

5. Now Select "Estimate Equation" from these options. then the new window will be open and would be like as follows.

6. Put your DV and IVs here with constant (c) in the equational form. the demo will be as follows. After putting variables click on OK.

7. After click results of OLS will be displayed on your screen. Like as

--------------------------------------------------------------------------------------------------------------------------

Now we are going to Interpret the Result completely.

Dependent

Variable: GDP

Method:

Least Squares

Date:

02/13/20 Time: 22:48

Sample:

1980 2019

Included observations: 40

|

||||

Variable

|

Coefficient

|

Std.

Error

|

t-Statistic

|

Prob.

|

C

|

3.633130

|

1.449609

|

2.506284

|

0.0169

|

INFLATION

|

-0.199112

|

0.085762

|

-2.321683

|

0.0260

|

PRICES

|

0.010102

|

0.017605

|

0.573820

|

0.5697

|

POPULATION

|

-9.83E-08

|

1.37E-06

|

-0.071797

|

0.9432

|

R-squared

|

0.491027

|

Mean dependent var

|

4.005952

|

|

Adjusted

R-squared

|

0.448612

|

S.D. dependent var

|

0.829710

|

|

S.E.

of regression

|

0.616105

|

Akaike info criterion

|

1.963840

|

|

Sum

squared resid

|

13.66507

|

Schwarz criterion

|

2.132728

|

|

Log

likelihood

|

-35.27681

|

Hannan-Quinn criter.

|

2.024905

|

|

F-statistic

|

11.57688

|

Durbin-Watson stat

|

2.041251

|

|

Prob(F-statistic)

|

0.000018

|

|||

Above mentioned randomly values are taken from the

web. We have 40 observations. from the year 1980 to 2019. We have the following

results,

Ho:

there is no association between GDP and Inflation, Prices and Population.

Ha:

there is some no association between GDP and Inflation, Prices and Population.

Results.

When P-value is less

than 5% then we accept the alternative hypothesis. Now we can observe that GDP has

negative signification relationship with inflation and negative in-significant

relationship with the population. Meanwhile have positive in-signification relation

with the price. R-Square clarifies that our

independent variables are explaining 49% variation of our dependent variable. Our

F-static is higher than our Prob (F-static) which explains that our independent

variables (price, inflation, and population) are jointly affecting our dependent

variable (GDP). Hannan criter and Durbin Watson stat is more than 2 which

indicates us there is no problem of auto-correlation prevailing in our model. Average (mean) of the dependent variable is 4.00s

whereas mean can be deviated from its central point by 0.82. The standard error of regression explains the

deference of the actual and estimated value of the dependent and independent variables.

So here S.E of regression explains the difference between actual and estimated

value has 0.61 differences.

Subscribe to:

Comments (Atom)